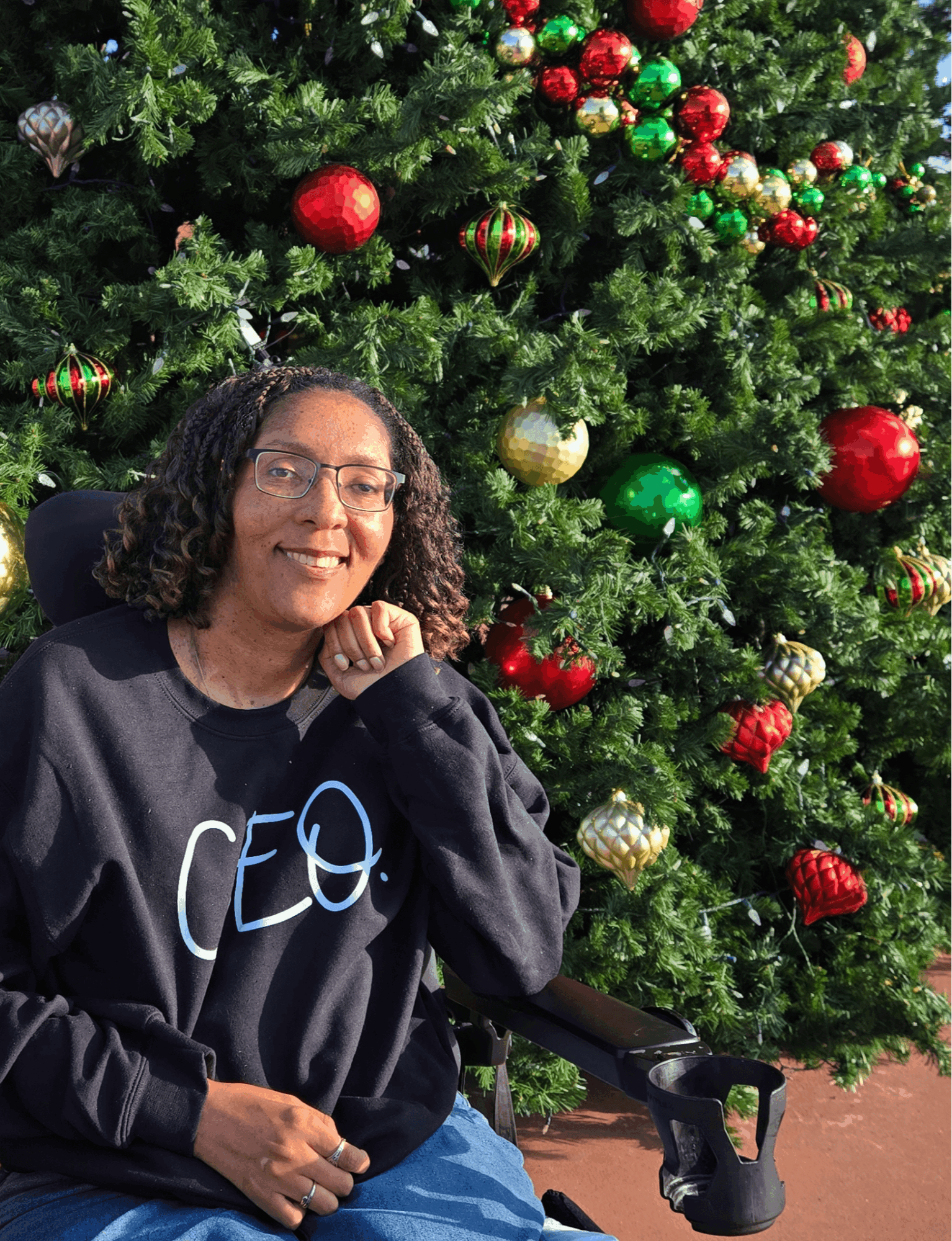

Today we’d like to introduce you to April Warren.

Hi April, can you start by introducing yourself? We’d love to learn more about how you got to where you are today?

My Insurance Journey

My insurance career began out of necessity. I needed a job that allowed me to work from home, and because of my disability, traditional employment wasn’t easy to find. While searching online, I stumbled across several insurance openings. I had zero insurance experience at the time, but something about it caught my interest.

I talked with a recruiter, took a chance, signed up for the training—and I ended up loving what I was learning. I studied hard, took my state exams, and passed both the Life and Health portions on the first try. (Yes… Go April!)

I started in life insurance, but realized it wasn’t my long-term fit. Instead, I discovered a real passion for advanced markets. I wrote a few IUL policies, got annuity certified, and planned to dive deeper into that field. But just as I wrapped up the certification, Open Enrollment arrived.

Since I also had my health license, I decided to put it to use—and that’s where everything clicked. I learned the ACA process, studied health insurance in depth, and found that helping people protect their health became one of my greatest strengths.

As a broker, I work with multiple carriers and have access to a wide range of products. Matching the right person with the right plan feels like solving a puzzle—and when you get it right, the appreciation you get from a relieved client is priceless.

Along the way, I didn’t stop expanding. I added Medicare to my toolbox, so now I can help clients at every stage of life:

Life insurance. Health insurance. Advanced markets. Medicare.

If it protects a family or their finances, I’m here for it.

Eventually, I took the leap and opened my own agency: Integrity Financial Solutions, LLC. What started as feeling like I had limited options has turned into a career full of opportunity, choice, and freedom. I get to choose who I work with, what I focus on, and how I grow.

Right now, with Open Enrollment for both Medicare and under-65 health in full swing, that’s where my attention is. When the new year begins, I plan to brush up on annuity training and keep expanding.

Because honestly?

The way I feel… the sky is the limit.

Alright, so let’s dig a little deeper into the story – has it been an easy path overall and if not, what were the challenges you’ve had to overcome?

The Obstacles I Faced Along the Way

My path into the insurance world was not easy. In fact, every step forward came with a challenge attached to it.

During my very first Open Enrollment training — one of the most important times in the health insurance industry — I was in and out of the hospital. I was trying to learn a brand-new career, but my body kept throwing me curveballs. That first Open Enrollment season, I was only able to work for about two weeks before being hospitalized again. It was emotional, frustrating, and honestly exhausting.

But even during those setbacks, I never let go of the dream I had for myself.

And maybe that determination runs deeper than I realized… I was born on Martin Luther King Jr.’s birthday, January 15th — so maybe dreamers really are born in January. 😄

Between hospital stays, recovery periods, and ongoing health issues, I had every reason to quit. But instead of stopping, I made a promise to myself:

Every time I was able to get back up, I would pick up right where I left off.

And I did.

Whether it was two weeks or two months, the moment I was able to resume business, I jumped back in. I stayed focused. I kept learning. I kept growing. Those small steps forward — taken in between some very large obstacles — built the foundation I stand on today.

These challenges didn’t stop me.

They shaped me.

They taught me resilience.

They made me the agent, the business owner, and the woman I am now.

Alright, so let’s switch gears a bit and talk business. What should we know?

Why I Chose the Name “Integrity”

The name Integrity wasn’t chosen by accident. I wanted my business name to say something about who I am and what clients can expect when they trust me with their personal health and financial information. Before opening my agency, I had two Facebook profiles — Warren Agency – Life Insurance and Warren Life & Health Consultants — but once I made the decision to get a full business license and go all in, I wanted a name that carried weight, respect, and trust.

Sure, you can use your own name and still be reputable, but for me, choosing “Integrity” was a statement. It reflects my character, my intentions, and my commitment to doing what’s right — especially since my business is entirely online and I’ve never met most of my clients in person, aside from the friends I’ve helped along the way.

My hope is simple:

I want to be known for being fair, honest, and trustworthy.

If I ever stop living up to the name, then I’d have to change it!

I’m also incredibly proud that, aside from the help of God, I built this business on my own. And yes… ChatGPT has thrown in a helping hand here and there 😄 but no other human has assisted in this startup. I’ve made mistakes — plenty of them — but honestly, that’s the best way to learn. Every misstep has taught me what not to do next time.

My philosophy is straightforward:

Do your due diligence.

Prepare yourself the best you can.

Trust God.

And go for it.

I work alone, but I always show up. I’m the one awake at 2:00 a.m. putting the pieces of a policy together. I’m the one double-checking details to make sure everything is right. When I give my word, I follow through.

Your information is safe with me.

Your trust means everything to me.

And yes… I love referrals! 😄

We’d be interested to hear your thoughts on luck and what role, if any, you feel it’s played for you?

Why I Believe I’m Here

I don’t believe any of this is luck — I believe it’s the grace of God.

Back in 2021, I spent 45 days at UT Medical Center battling COVID-19. I could barely breathe, and eventually I had to be put on a ventilator. To this day, I’m not even sure how long I was on it. I don’t ask my mother for many details, because I know that time was terrifying for her.

Both of my parents were told the same heartbreaking words:

“We don’t know if she’s going to make it home.”

But I did.

And because of that, I believe with everything in me that I’m here for a reason. When you come that close to losing your life, it changes the way you see everything. It gives you clarity. It gives you urgency. It gives you purpose.

That experience is a huge part of why I push myself so hard today.

Why I want to be excellent in everything I put my hands on.

Why I’m determined to live fully, love deeply, and do meaningful work with the time God has allowed me to keep.

I don’t take a single day for granted.

I know I’m here for a purpose — and I intend to live it out.

Pricing:

- Depends on age.

- Depends on gender.

- Depends on health.

- Depends on how much you are willing to invest in your protection..

- Depends on family structure.Just you, you and spouse, you and children, or the family

Contact Info:

- Facebook: https://www.facebook.com/april.warren.115

- LinkedIn: https://www.linkedin.com/in/april-warren115

- Yelp: https://www.yelp.com/biz/integrity-financial-solutions-maryville

- Other: https://www.bbb.org/us/tn/maryville/profile/financial-services/integrity-financial-solutions-llc-0533-90043548